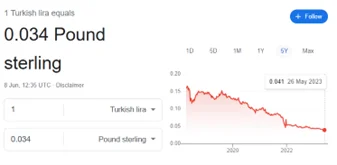

An alarming wake-up call has been issued today, as Turkey’s Lira plunges 7%, reaching an unprecedented low against both the Pound and the U.S. Dollar. For a currency that, not so long ago, was trading at approximately 3 Lira to the pound, this represents a steep and disturbing fall from grace.

Delving into the Past Decade: Türkiye’s Economic Policy and Its Consequences

Many might question, what’s sparking this drastic downward spiral. To find the answer, we need to delve into the past decade of Türkiye’s economic policy.

The root of the problem can be traced back to the Central Bank’s pursuit of ‘unorthodox‘ economic policy. While innovative approaches and outside-the-box thinking can sometimes lead to success, in this case, it appears to have generated an unstable economic environment and a shaken trust in the Lira.

But change is on the horizon. The recent electoral victory of President Erdogan brings with it the promise of a new finance minister, the highly regarded Mehmet Simsek. Formerly a strategist for Meryll Lynch, Simsek is anticipated to steer the economic policy back towards a more orthodox route. However, this is not without its drawbacks.

One of the consequences of this shift towards orthodox policies is less economic control, implying a potential for short-term pain. Simsek might be the market’s preferred choice, but he cannot perform miracles.

Turkey’s Plummeting Lira: Escalating Costs and Salary Reductions

The state of Turkey’s foreign exchange reserves adds to the concern. With reserves now in the negative, the central bank is in no position to protect the Lira. State lenders, too, seem to be easing their defences.

But what does this mean for the people of Türkiye? As the Lira’s value plummets, the cost of living for locals has escalated sharply. With salaries denominated in Lira, real-time reductions in their salaries are being witnessed.

This significant adjustment in the Lira’s value signifies an economic shockwave with the floor yet unknown. While the long-term effects of these changes are uncertain, the short-term impact on the citizens of Türkiye is, unfortunately, all too real.

The situation unfolding in Turkey serves as a harsh reminder of the fragile relationship between economic policies, market confidence, and the value of a country’s currency. Only time will tell how Türkiye will navigate this economic turbulence and what the future holds for the Lira.

Discover how investing in the S&P 500 today can be a viable short-term strategy in our previous post. Gain valuable insights into the potential risks and rewards of this investment approach, as well as expert tips for maximizing returns. Don’t miss out on this valuable information that can help shape your investment decisions. Read our previous post on “Investing in the S&P 500 Today: A Short-Term Strategy?” now.